FRIDAY, MAY 25, 2012

Unauthorized upgrades rob MAS of RM200 mil

A Syndicate Within. Malaysia Airlines has uncovered a ring involving some senior executive who have been enriching themselves by upgrading thousands of Economic Class passengers to Business Class every year, denying the financially-strapped national carrier of much-needed revenue.

Last year alone this syndicate let go over 50,000 upgrades without getting prior approval from those authorized to do so. I am not sure how they made money from "selling" these upgrades or if they were in cahoots with travel and tour agents, but by end last year the malpractice had cost the national carrier more than RM200 million in lost income!

These unauthorized upgrades are not the same as the so-called "discretionary" upgrades like the one MAS Deputy CEO Rashdan aka Danny's maid supposedly enjoyed on a flight from MH122 from Sydney to Kuala Lumpur on Jan 1 2012, an accusation Danny has denied vehemently but which the whistle-blowing Member of Parliament, YB Wee Choo Keong plans to bring up again in Parliament next month [read his Questions for June Parliament].

After the share swap deal with Air Asia was rescinded, all eyes have been trained on Malaysia Airlines' new CEO Ahmad Jauhari whose task is to turn check the carrier's decade-long decline. There have been interesting developments. A couple of days ago, for example, it was reported that the management was negotiating with MAS Catering to review a one-sided 25-year contract with a company that belongs to the brother of the airline's advisor, (former PM) Abdullah Ahmad Badawi.

If AJ can get the caterers to agree to his terms, the airline might be able to make savings of as much as 15 per cent of the existing total F&B bills.AJ has said that his turnaround plans hinge greatly on making the best out of available resources and stopping the leakages.

I say, Happy Fishing! I hope AJ goes for the big fish and not just the little ones ....

DESIDERATA: Sext is an item for wanna-to-be billionaire the RIGHT or WRITE WAY! __ KNOT like wan former MCA whose son became the youngest billinaire-at-27 and rolled out by The Srtar and other obedient MSM as a model yuouth-to-emulate. My foot! it hurst.... NOW papa ex-MCA is in court for PKFZ related fiaisco -- WJHEN BE BE SUNNY BOY'S TURN?

Make it fast -- VOTE4CHANGE cometh G#-13, an advertising message from your friendly hoRst, can? WTbf, do I have to seekbA permit to enter my own home?

Related by-nama only Malaysian maketh it to "billionaire" list Down Under, which proveth the Malaysian brain actually is worth a lot aMore overseas. Back in NegaraKu, they practise the "Beggar thy neighbour" policy, IMHO-lah, so UMNO-rites, sue me and I'll hand over the bill to that Oz Choing who maketh GOoD. God bless him that moment in time he made the right decision to make Australian the Lucky Country his lucky strike. Me, a'm a teatotaller, I no drink, no smoke, I drinko only TEAS! How is this lust sentence relevant, you dare to aRsEk? Hey, get the hear out of hell! -- YL, Desi, stealaSsknottyasB4 I became a half-Ozzie earning AUD for 13 years...:( OR :)

Chong: Increased his wealth by A$50mil (RM153.6mil).

Chong: Increased his wealth by A$50mil (RM153.6mil).

Sinnathamby: Close to joining the Billionaires’ Club.

Sinnathamby: Close to joining the Billionaires’ Club.

After the share swap deal with Air Asia was rescinded, all eyes have been trained on Malaysia Airlines' new CEO Ahmad Jauhari whose task is to turn check the carrier's decade-long decline. There have been interesting developments. A couple of days ago, for example, it was reported that the management was negotiating with MAS Catering to review a one-sided 25-year contract with a company that belongs to the brother of the airline's advisor, (former PM) Abdullah Ahmad Badawi.

If AJ can get the caterers to agree to his terms, the airline might be able to make savings of as much as 15 per cent of the existing total F&B bills.AJ has said that his turnaround plans hinge greatly on making the best out of available resources and stopping the leakages.

I say, Happy Fishing! I hope AJ goes for the big fish and not just the little ones ....

DESIDERATA: Sext is an item for wanna-to-be billionaire the RIGHT or WRITE WAY! __ KNOT like wan former MCA whose son became the youngest billinaire-at-27 and rolled out by The Srtar and other obedient MSM as a model yuouth-to-emulate. My foot! it hurst.... NOW papa ex-MCA is in court for PKFZ related fiaisco -- WJHEN BE BE SUNNY BOY'S TURN?

Make it fast -- VOTE4CHANGE cometh G#-13, an advertising message from your friendly hoRst, can? WTbf, do I have to seekbA permit to enter my own home?

Related by-nama only Malaysian maketh it to "billionaire" list Down Under, which proveth the Malaysian brain actually is worth a lot aMore overseas. Back in NegaraKu, they practise the "Beggar thy neighbour" policy, IMHO-lah, so UMNO-rites, sue me and I'll hand over the bill to that Oz Choing who maketh GOoD. God bless him that moment in time he made the right decision to make Australian the Lucky Country his lucky strike. Me, a'm a teatotaller, I no drink, no smoke, I drinko only TEAS! How is this lust sentence relevant, you dare to aRsEk? Hey, get the hear out of hell! -- YL, Desi, stealaSsknottyasB4 I became a half-Ozzie earning AUD for 13 years...:( OR :)

Monday May 28, 2012

Malaysian-born mining magnate makes Australia’s Rich 200 list

MELBOURNE: Mining magnate Sam Chong has become Australia's first Malaysian-born billionaire, according to the latest Business Review Weekly's (BRW) Rich 200 list.

The 69-year-old, who was born in Tanah Rata, Cameron Highlands, increased his wealth by A$50mil (RM153.6mil) from last year's A$950mil (RM2.9bil).

Chong: Increased his wealth by A$50mil (RM153.6mil).

Chong: Increased his wealth by A$50mil (RM153.6mil).

Chong, who is married with one child, came to Australia in 1973 to study mining engineering and later took a job with Queensland Coal Mine Management, now known as Jellinbah Group, in the 1980s.

He has a 23% stake in the company and lives in Brisbane.

Another Malaysian, who is close to joining the Billionaires' Club, is Queensland property developer Maha Sinnathamby, 72, who is listed as having A$820mil (RM2.5bil).

He moved to Sydney after leaving St Paul's Institution in Seremban to complete an engineering degree.

Sinnathamby is the master developer of the 2,860ha Greater Springfield land parcel which has become home to over 23,000 residents and 9,000 students.

It was established in 1991.

Sinnathamby: Close to joining the Billionaires’ Club.

Sinnathamby: Close to joining the Billionaires’ Club.

Only 13% of the acreage, which he and a friend Bob Sharpless bought for just A$7.2mil (RM22.1mil) in the early 1990s, has been developed.

Once completed, the investment, about 45km from Brisbane, is calculated to be worth over A$23bil (RM70.6bil).

More than A$3.2bil (RM9.83bil) has been invested to date.

All four of Sinnathamby's children are involved in his property development.

Two other Malaysians have again made the BRW Rich list this year.

David Teoh and his wife Vicky, both 56, have increased their wealth from A$484mil (RM1.48bil) last year to A$525mil (RM1.61bil). - Bernama

DESIDERATA: Sext2 is an item for you Market playerrs -- I guess for Malaysians who don't believe what Desi says: Jangan-lha dekati Bursa Malaysia -- manyak-manyak UMNO crocodiles sSINdicates makan-makan you LOL! Sei liauliau LOH!

OR if you are a selfmade millionaire, or have Bank overdraft up to a billion bucks -- you punya bapak menteri kee? -- go prayPLAYpray the stocks-lah, but read the following from another SAM! via MChronicle:)~~~~

Monday, 28 May 2012 08:04

DESIDERATA: Sext2 is an item for you Market playerrs -- I guess for Malaysians who don't believe what Desi says: Jangan-lha dekati Bursa Malaysia -- manyak-manyak UMNO crocodiles sSINdicates makan-makan you LOL! Sei liauliau LOH!

OR if you are a selfmade millionaire, or have Bank overdraft up to a billion bucks -- you punya bapak menteri kee? -- go prayPLAYpray the stocks-lah, but read the following from another SAM! via MChronicle:)~~~~

Monday, 28 May 2012 08:04

Global Stock Markets: WHERE DO WE STAND NOW

Written by Sam Chee Kong, Malaysia Chronicle

Rate this item

(1 Vote)

Since our last analysis on the VIX or Fear indicator on 13/05/2012, the reading was 19.89 and the latest reading as of 27/05/2012 is 21.76. It did managed to touched 25 point on 18/5/2012.

To refresh our memory, the indicator VIX can be interpreted as when the VIX reading is less than 30 means investors are feeling positive and complacent.

And if it moves towards 50 and beyond means investors are nervous and indecisive and hence the markets are unstable. Anyway an increase of 2 points in the indicator since our last analysis represents an increase in the volatility of Stock Markets.

Let’s revisit some selective markets for next week’s analysis. Below is the Executive Summary on our analysis on selected Global Markets.

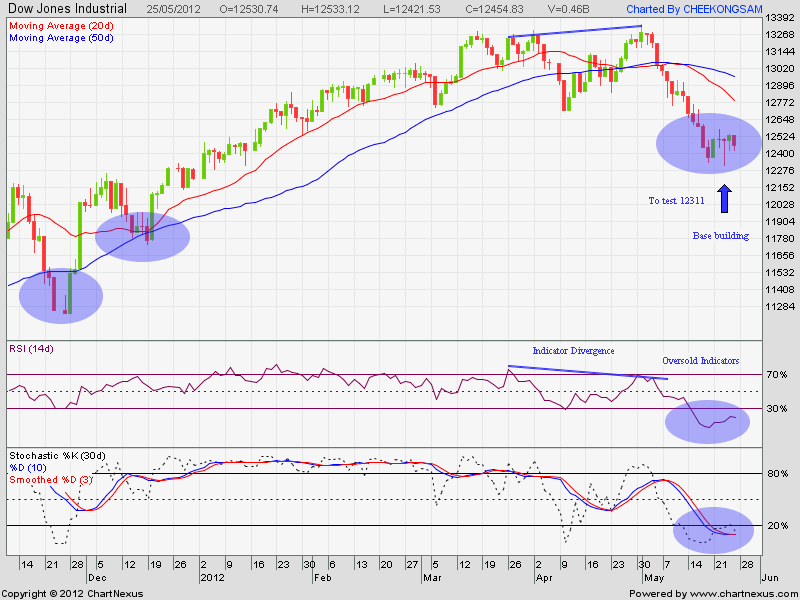

America – Dow Jones Industrial

As for Dow Jones, it appears to be oversold and the support lies within the 12300 points level. There is also a base building at around that level which helped to capped the losses at the 12300 level.

The Dow appears weak and any indication of a strong rebound in the vicinity of high3 digits is yet to be ascertained. Any indication of a big move will depend on how Europe play out next week.

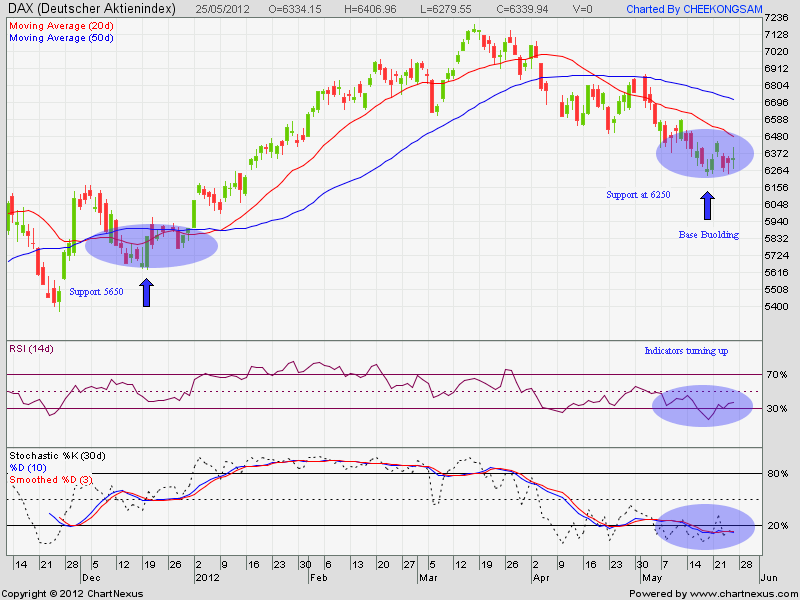

German - DAX

The DAX also seems to be forming a base which will help to cap any fall in the index. Indicators are also oversold and is waiting for any piece of good news to act as a catalyst for a big rebound.

Japan‘s Nikkei

The Japanese Nikkei has been free falling since it broke the 9300 level which we have predicted a few weeks ago. However, any further fall should be capped at the moment due to the highly oversold indicators and also a base building at the current price level. Seems like selling is overdone.

Hong Kong – Hangseng Index

Again the Hangseng seems to be falling off the cliff since it broke the 20000 level which we predicted a few weeks ago. It might test the 18300 level next week because it seems to have broken off from the base building cluster. In other words more room to fall.

China – Shanghai Stock Exchange (SSE)

The SSE seems to be in a crossroad. It now seems to be tethering at the support level at 2330. Its indicators are not in an utterly oversold condition, so we expect more room to drop in the SSE next week.

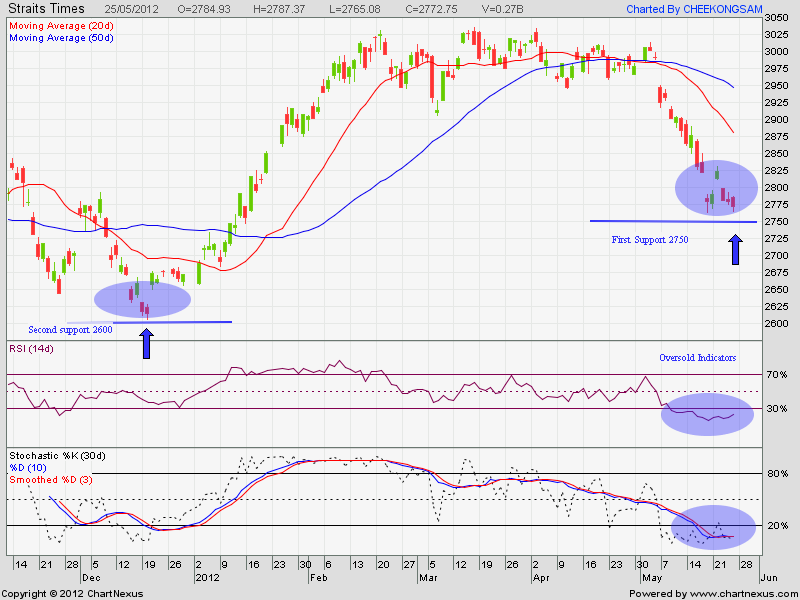

Singapore – Straits Times

What we see from the STI is that it also tethering in the 2750 support level. The STI seems to be weak and we are afraid it will test the 2750 next week, Any breach will be big trouble for the STI. The only consolation for the STI is the oversold indicators.

Indonesia – Jakarta Stock Exchange IHSG

Jakarta ‘s IHSG seems to be breaking off from the pack and we expect to see further weakness in the IHSG next week. We expect it to test the 3850 level on Monday and with the announcement of unfriendly foreign investors policy does not augur well for the Indonesian economy and stock market. If approved,

Foreign Investors are required to,

- Stagardly sell down their stakes to local companies in stages until the 10th year, so as to increase local participation in the Mining Sector

- Limit on the percentage of foreign ownership in the Banking Sector.

Such policies are known to backfire in the long run especially during trying economic times like now. Such policies will only quicken the exodus of foreign owned companies from Indonesia. With global economic outlook not at its best in the coming few years, the last thing you need is the exodus of foreign companies. Jobs will be lost, revenue will be cut, various trickle down effects (multiplier effect in economics) will be halted. So our outlook on the Indonesian stock market will be negative bias for the months to come.

Another thing to worry about the Indonesian stock market is that the tide will turn against the 2nd and 3rd liners. For the past two weeks the Blue chips BELL WEATHERS like United Tractors,Bank Rakyat Indonesia, Telkom Indonesia and etc have been dropping something like 20-30% from their peak. We believe the NEXT SHOE to drop in the Indonesian Stock Market will be the speculative 2nd and 3rd liners. Our assumption is based on the fact that some of their speculative BELL WEATHERs like ENRG, DEWA, FREN and etc are losing ground. Lets take a look at ENRG.

ENRG which is one of the bell weather for speculative stocks in IHSG seems to be breaking off from the pack. We expect it to test the 145 level next week and hopefully it will hold.

Kuala Lumpur – KLCI

In line with our earlier prediction, the KLCI will withstand this downturn much better than the rest due to its positive Divergence in the Price Line and Indicators. Instead of going down it did exactly the opposite and reverse its course. We see further strengthening of the KLCI in the coming week.

Brazil – Bovespa

The Bovespa seems to have hit an inter mediate bottom as can be seen by the 2 long leg hammer which provided a strong support at 53500 level. Indicators are also off their highs and we expect to see a strong rebound in the Bovespa next week.

Nevertheless we are seeing some deterioration on both fundamental and technical aspects in Global Markets. Developments in Greece does not help either and with the conflicts flaring up in the Middle East will do no good to oil prices either. The other big worry is the financial crisis is making its way to Spain. There are reported bank runs in Bankia which is Spain’s 4th largest bank. In other words the contagion had spread and hopefully the bank runs can be contained. If not we will be looking at some serious trouble ahead because ratings agency will begin its next wave of downgrading of banks all over Europe.

On the international front, things aren’t looking as rosy as it is despite what is being reported in the mainstream media that all is well and in control. Despite 3 rounds of interest rates cuts totaled 350 basis points (3.5%), Brazil which is the 7th largest economy in the world, still seen its economy contracting for the past 3 quarters. China’s exports also has taken a hit and its housing prices in Shanghai has been falling for the past 3 quarters and more than 20%,. In other words, we are not out of the woods yet.

We remain CAUTIOUS on Global Markets ahead although most are oversold, we don't see any signs that can point to a significant rebound in prices anytime ahead. Any position we are willing to take will only be day trading with no positions held overnight so as to reduce any risk of unexpected development in global markets overnight.

Related Stories:

Malaysia Chronicle

CLICK IN TO READ MORE AT Samcheekong.blogspot.com

No comments:

Post a Comment