From the sun's columnist todie, comparing 1MDB saga with ALICE IN WONDERLAND; DEsi ditto earlier, also quoting: "Curiouser and curiouser..."

Making Sens - 1MDB – A wonderland saga

Posted on 20 April 2016 - 08:05pm

Last updated on 21 April 2016 - 12:10am

Last updated on 21 April 2016 - 12:10am

"CURIOUSER and curiouser," said Alice as she grew to more than nine feet high in Lewis Carroll's fabled novel Alice's Adventures in Wonderland.

This is the likely response of non-partisan readers of often contradictory articles about 1Malaysia Development Berhad (IMDB), the report by the Public Accounts Committee (PAC) and strongly-worded statements by Abu Dhabi's sovereign wealth fund, International Petroleum Investment Company (IPIC).

In a joint announcement on April 11, IPIC and its subsidiary Aabar Investments PJS (Aabar) categorically denied Aabar Investments PJS Ltd, established in the British Virgin Islands (Aabar BVI), is "an entity within either corporate group". Both IPIC and Aabar also said they had received no payments from Aabar BVI.

In response, 1MDB said it was "curious" IPIC and Aabar had waited "until April 2016" to issue a denial and was surprised "neither IPIC nor Aabar has knowledge of, nor has benefited from, payments made by IMDB to Aabar BVI."

Under a debt-asset swap agreement on May 28, 2015 involving Aabar, Malaysia's Ministry of Finance (MOF) and 1MDB, IPIC agreed to:

» provide US$1 billion to enable 1MDB to settle its liabilities;

» pay interest on the US$3.5 billion bonds;

» repay the US$3.5 billion bond; and

» forgive certain 1MDB debts.

In return, 1MDB would transfer to IPIC by June 30, 2016 assets with an aggregate value of all the sums paid by IPIC.

DAP MP Tony Pua says the value of assets 1MDB must transfer to IPIC total US$4.7 billion – US$1 billion to settle 1MDB's liabilities, US$3.5 billion for the 2012 bonds and up to US$200 million in interest payments.

Two days after IPIC's statement, 1MDB did an about-turn and acknowledged it could have been a victim of fraud.

On Monday, IPIC accused 1MDB and MOF of failing to honour their obligations and terminated the debt-asset swap deal.

According to a news report, a US$50 million payment on the 1MDB bonds was due on Monday, which IPIC had undertaken to pay.

This sequence of events prompts several questions.

If neither IPIC nor Aabar received the US$3.5 billion 1MDB reputedly paid to Aabar BVI in four tranches, who was the lucky beneficiary? Can 1MDB recover the US$3.5 billion paid to Aabar BVI?

Did 1MDB check who owned Aabar BVI? IPIC's annual reports from 2011 to 2014 and the interim 2015 report show Aabar BVI isn't listed as a subsidiary.

Does IPIC's termination of the debt-asset swap agreement mean 1MDB's financial obligations could increase by US$4.7 billion? If 1MDB doesn't have sufficient funds, will MOF have to assume responsibility for paying 1MDB's debts?

Was the US$50 million on 1MDB bonds paid on time? Would non-payment trigger a cross-default on 1MDB's other financial commitments estimated at US$5.1 billion?

PAC said it was unable to confirm a US$2.1 billion payment to Aabar BVI while another US$1.37 billion was transferred to the latter without approval from 1MDB's board.

Since banks require a board resolution authorising a transaction before transmitting the funds, how was the US$1.37 billion transferred to Aabar BVI without 1MDB directors' approval? Did 1MDB auditors query this unsanctioned payment to Aabar BVI?

The PAC report showed 1MDB's management, helmed by then CEO Datuk Shahrol Azral Ibrahim Halmi, ignored board directives on 19 occasions, deceived the board six times and the auditors thrice.

Shahrol was able to disregard 1MDB directors because the real power was with the shareholder, the bipartisan PAC report suggests.

Article 117 of 1MDB's Articles of Association requires the prime minister, as chairman of the advisory committee, to approve any appointments and terminations of directors and top managements as well as any "financial commitments (including investments) restructuring or matters involving government guarantees."

The PAC has recommended enforcement agencies investigate Shahrol. Can Shahrol claim as a defence that he was carrying out the directives of 1MDB's ultimate approving authority?

An early warning signal occurred last year. In April 2015, Khadem al-Qubaisi was abruptly removed as IPIC managing director and Aabar chairman while Mohamad al-Husseiny was replaced as Aabar CEO.

Did news that Qubaisi and Husseiny were no longer employed by IPIC and Aabar respectively prompt 1MDB to contact the two Abu Dhabi corporations?

When Abu Dhabi's central bank froze the accounts of both Qubaisi and Husseiny and directed major banks in the United Arab Emirates to provide information about these two men's deposits and transactions, did an amber light flash in 1MDB's corporate headquarters?

Reports indicate both men are now also being investigated by Swiss authorities.

In short, 1MDB is a wonderland saga; it is like Lewis Carrol's novel – with a multiplicity of questions and a paucity of rationale answers.

Opinions expressed in this article are the personal views of the writer and should not be attributed to any organisation she is connected with. She can be contacted at siokchoo@thesundaily.com

This is the likely response of non-partisan readers of often contradictory articles about 1Malaysia Development Berhad (IMDB), the report by the Public Accounts Committee (PAC) and strongly-worded statements by Abu Dhabi's sovereign wealth fund, International Petroleum Investment Company (IPIC).

In a joint announcement on April 11, IPIC and its subsidiary Aabar Investments PJS (Aabar) categorically denied Aabar Investments PJS Ltd, established in the British Virgin Islands (Aabar BVI), is "an entity within either corporate group". Both IPIC and Aabar also said they had received no payments from Aabar BVI.

In response, 1MDB said it was "curious" IPIC and Aabar had waited "until April 2016" to issue a denial and was surprised "neither IPIC nor Aabar has knowledge of, nor has benefited from, payments made by IMDB to Aabar BVI."

Under a debt-asset swap agreement on May 28, 2015 involving Aabar, Malaysia's Ministry of Finance (MOF) and 1MDB, IPIC agreed to:

» provide US$1 billion to enable 1MDB to settle its liabilities;

» pay interest on the US$3.5 billion bonds;

» repay the US$3.5 billion bond; and

» forgive certain 1MDB debts.

In return, 1MDB would transfer to IPIC by June 30, 2016 assets with an aggregate value of all the sums paid by IPIC.

DAP MP Tony Pua says the value of assets 1MDB must transfer to IPIC total US$4.7 billion – US$1 billion to settle 1MDB's liabilities, US$3.5 billion for the 2012 bonds and up to US$200 million in interest payments.

Two days after IPIC's statement, 1MDB did an about-turn and acknowledged it could have been a victim of fraud.

On Monday, IPIC accused 1MDB and MOF of failing to honour their obligations and terminated the debt-asset swap deal.

According to a news report, a US$50 million payment on the 1MDB bonds was due on Monday, which IPIC had undertaken to pay.

This sequence of events prompts several questions.

If neither IPIC nor Aabar received the US$3.5 billion 1MDB reputedly paid to Aabar BVI in four tranches, who was the lucky beneficiary? Can 1MDB recover the US$3.5 billion paid to Aabar BVI?

Did 1MDB check who owned Aabar BVI? IPIC's annual reports from 2011 to 2014 and the interim 2015 report show Aabar BVI isn't listed as a subsidiary.

Does IPIC's termination of the debt-asset swap agreement mean 1MDB's financial obligations could increase by US$4.7 billion? If 1MDB doesn't have sufficient funds, will MOF have to assume responsibility for paying 1MDB's debts?

Was the US$50 million on 1MDB bonds paid on time? Would non-payment trigger a cross-default on 1MDB's other financial commitments estimated at US$5.1 billion?

PAC said it was unable to confirm a US$2.1 billion payment to Aabar BVI while another US$1.37 billion was transferred to the latter without approval from 1MDB's board.

Since banks require a board resolution authorising a transaction before transmitting the funds, how was the US$1.37 billion transferred to Aabar BVI without 1MDB directors' approval? Did 1MDB auditors query this unsanctioned payment to Aabar BVI?

The PAC report showed 1MDB's management, helmed by then CEO Datuk Shahrol Azral Ibrahim Halmi, ignored board directives on 19 occasions, deceived the board six times and the auditors thrice.

Shahrol was able to disregard 1MDB directors because the real power was with the shareholder, the bipartisan PAC report suggests.

Article 117 of 1MDB's Articles of Association requires the prime minister, as chairman of the advisory committee, to approve any appointments and terminations of directors and top managements as well as any "financial commitments (including investments) restructuring or matters involving government guarantees."

The PAC has recommended enforcement agencies investigate Shahrol. Can Shahrol claim as a defence that he was carrying out the directives of 1MDB's ultimate approving authority?

An early warning signal occurred last year. In April 2015, Khadem al-Qubaisi was abruptly removed as IPIC managing director and Aabar chairman while Mohamad al-Husseiny was replaced as Aabar CEO.

Did news that Qubaisi and Husseiny were no longer employed by IPIC and Aabar respectively prompt 1MDB to contact the two Abu Dhabi corporations?

When Abu Dhabi's central bank froze the accounts of both Qubaisi and Husseiny and directed major banks in the United Arab Emirates to provide information about these two men's deposits and transactions, did an amber light flash in 1MDB's corporate headquarters?

Reports indicate both men are now also being investigated by Swiss authorities.

In short, 1MDB is a wonderland saga; it is like Lewis Carrol's novel – with a multiplicity of questions and a paucity of rationale answers.

Opinions expressed in this article are the personal views of the writer and should not be attributed to any organisation she is connected with. She can be contacted at siokchoo@thesundaily.com

From jebatmustdie.wordpress.com:~~~~

jebatmustdie

This site is dedicated to opinion pieces by pundits and the intelligentsia; mostly on politics and socio-economics

Najib and his goons live in a vacuum devoid of any links to reality

That is why they can still walk around,

making nonsensical statements amidst all the damaging reality that have

befallen unto them.

Take for instance, the latest news surrounding the 1MDB fiasco.

IPIC had terminated the debt-swap agreement and the Wall Street Journal have published new discovery that the instant billionaire named Najib Razak did receive billions of money from 1MDB via intermediary companies.

Before, we were told that all these

accusations were lies. No such money existed. Then they shifted the goal

post by saying he never received such money from 1MDB. Then they

changed the story by saying the money was a donation. The shameless

Najib even had the audacity to claim he did not use the money for

personal usage!

In June 2015, the liar said:

“Let me be very clear: I have never

taken funds for personal gain as alleged by my political opponents –

whether from 1MDB, SRC International or other entities, as these

companies have confirmed.”

As proven so many times (and exposed by the Attorney ‘cari makan’ General himself),

he did receive money from SRC International and in today’s article

published by WSJ, at least USD681 million came ultimately from 1MDB.

On top of that, he used millions of ringgit on a shopping spree for luxury items like clothing, handbags, jewellery etc!

Ahmad Maslan and Haron Don were right. This prime minister is very stupid for taking public funds and put it in his own private accounts.

Yet, many of his goons are living in

denial, making nonsensical claims to exonerate Najib Razak from any

wrongdoings. To them, receiving millions of money from SRC International

and then spent it lavishly around the world is not wrong. And this is

the least of Najib’s problems!

Some

of them were even more pathetic in claiming that the Petrosaudi and

1MDB joint venture was a government to government (G2G) business joint

venture. Everyone with enough common sense and above average

intelligence can easily find out from publicly available information that PetroSaudi was not a company belonging to the Saudi Government.

Some

of them were even more pathetic in claiming that the Petrosaudi and

1MDB joint venture was a government to government (G2G) business joint

venture. Everyone with enough common sense and above average

intelligence can easily find out from publicly available information that PetroSaudi was not a company belonging to the Saudi Government.

Yet, they wrote long extensive articles, mostly rubbish, just to justify their claims.

To no one’s surprise, it is now a fact

that PetroSaudi had swindled Malaysian money by the billions, and

supervised by the prime minister’s confidants. This was clearly stated

in the PAC Report (page 18-19),

where PetroSaudi’s owner is a swindler named Tarek Obaid and 1MDB

(without approval from its Board of Directors), had remitted billions of

money into this dodgy company.

In another instance, everyone with a bit

of knowledge in auditing would have known that 1MDB had terminated two

of their auditors within a span of 4 years. Husni Hanadzlah, the bumbling and ignorant Second Finance Minister LIED on national TV in June last year when he said it was a normal practice for auditors to be rotated.

It was a well known fact in the industry that EY and KPMG were sacked in 2010 and 2013 respectively.

But throughout last year some clueless

idiots in the social media had defended 1MDB by saying that these

auditors were not sacked. It was normal practice to change auditors,

they said. Thank God none of these idiots were chartered accountants or

financial experts. Otherwise people might question their business acumen

and qualifications.

A multi-billion ringgit company changing

auditors midway though an audit or employing 3 different audit firms

within 5 years is certainly a huge red flag.

And lo and behold! The PAC Report (page 68 & 71) indeed had reported that those two audit firms were terminated.

Now why would Malaysians want to believe

the nonsense propagated by paid individuals from JASA or in Facebook?

What is worse, this government uses taxpayers money to spread

disinformation and lies in order to defend Najib. What an unbelievable

thing to do.

Hopefully, there won’t be anymore noises

coming out from self appointed 1MDB spokespersons saying that the Cayman

units have value and are not worthless. That would be hilarious indeed.

When you lack common sense, you will make

nonsensical statements. People often find it hard to believe

nonsensical statements because people generally have a lot of common

sense. It was common sense to believe that the PetroSaudi – 1MDB JV was

not G2G. It was common sense to know that 1MDB auditors were sacked.

And it certainly is common sense to know

that billions of money in Najib Razak’s private accounts were not a

donation. It was certainly not for fighting ISIS nor was it to fight the

Jews. But yet all through 2015 and until today, some of these self

elected defenders of Najib’s crime would still believe that the money

was a donation meant for fighting Jews/ISIS/Muslim Brotherhood etc!

Maybe they loved being lied to and love

being ridiculed by the public. But this is not a surprise. Najib Razak

till this day is trying to carry whatever dignity he has left without

any due regard to the embarrassment he had caused himself, to his own

sycophants and to Malaysia in general. He is living in a vacuum devoid

of any connection to the current reality.

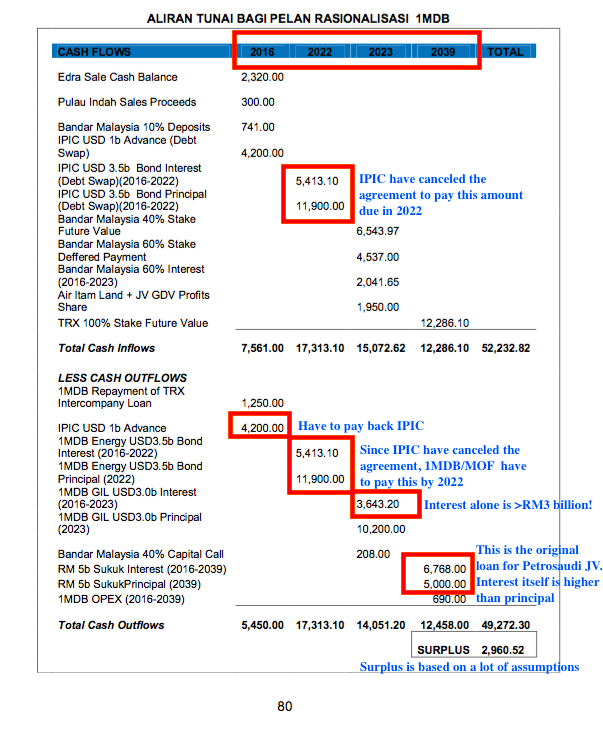

In January 2016, he declared that all RM40 billion of 1MDB has been settled. He is the Finance Minister yet he did not want to tell us that the real debt level of 1MDB is RM50 billion. Being transparent is of course, not in his vocabulary.

Look

at that face. We wonder what happened to all the millions of jewellery

he had purchased. Maybe the sycophants can give us some awareness about

their whereabouts.

But the best part is, what he didn’t want

Malaysians to know is the fact that 1MDB will settle all of its debts

only by the year 2039! And its success is based on huge amount of

assumptions (PAC Report page 81).

Below is how 1MDB plans to settle all its

needlessly accumulated debts. Obviously, the debts won’t be settled

anytime soon. Bear in mind, Najib did say not a sen of rakyat’s money

will be used to bail out 1MDB’s debts (they just had to sell rakyat’s

lands instead).

1MDB plans to repay ALL their debts by the time your grandchildren started to have their own children in 2039.

The vacuum container has been stretched

to its maximum and will burst anytime soon. This has been growing since

the inception of 1MDB. The business model was unsustainable from the start but true to Najib’s nature of being oblivious, they bulldozed their way without due regards to the law or good governance.

They are now fumbling every step of the way. Just now one of the ministers from ‘Parti Najib‘ even admitted that he plays dirty politics! Is that a wise thing to say?

Najib’s position has been untenable. He is surviving only through the misplaced loyalty of a few minions at his disposal.

You might also want to read:1) Malaysia Prime Minister’s Confidant Had Central Role at Troubled 1MDB Fund

2) As Malaysia Stands On An Economic Brink, Who To Believe?

3) WSJ claims funds from fake Aabar went to firm behind RM2.6b

4) 1MDB debt plan in doubt after collapse of IPIC deal, says Moody’s

5) Melayu Bermaruah- Siri 2

6) Why is Abu Dhabi walking away from Malaysia’s 1MDB?

7) Malaysia’s 1MDB and Abu Dhabi Feud Over Coming Bond Payment

8) State fund dispute puts 1MDB at risk of default

9) 1MDB Kencing IPIC ? Sudah2lah 1MDB Dan Najib oooi… Cukup2lah Malukan Nama Negara!

10) Laporan PAC Pasal 1MDB Pun Kena Edit?

No comments:

Post a Comment